Every investment decision is based on 3 factors.

- 01Safety

- 02Liquidity

- 03Returns

This informative guide provides a deep dive into various investment options, helping you understand the diverse opportunities available to grow your wealth. From traditional options like stocks and bonds to alternative investments such as real estate, cryptocurrencies, and peer-to-peer lending, you’ll gain insights into each option’s risks, rewards, and suitability for your financial goals. Whether you’re a novice investor looking to get started or a seasoned pro seeking to diversify your portfolio, this resource will equip you with the knowledge you need to make informed investment decisions. Start building your financial future today!

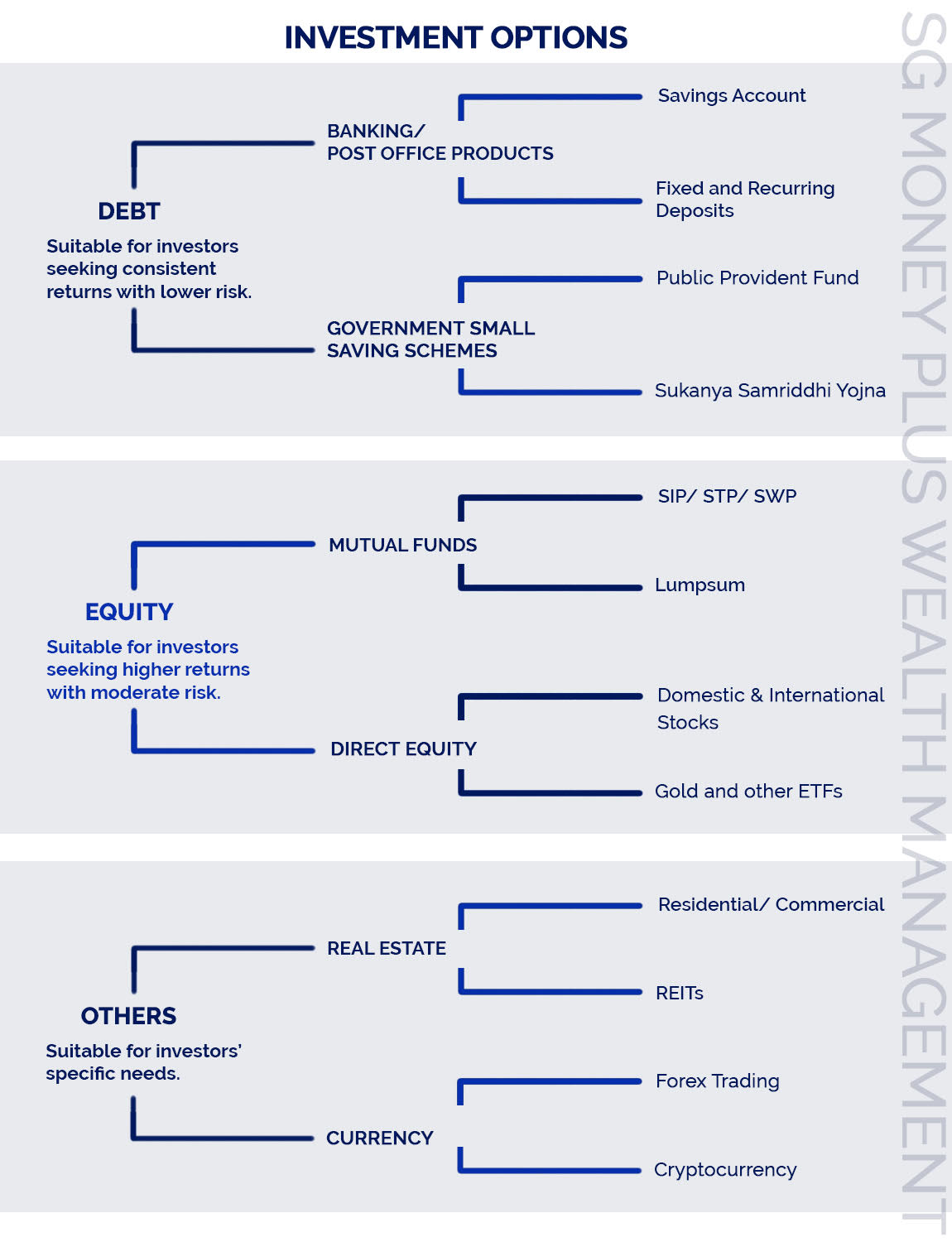

- 01DEBTSuitable for investors seeking consistent returns with lower risk

- 02EQUITYSuitable for investors seeking higher returns with moderate risk

- 03OTHERSSuitable for investors specific needs

One may invest in various banking products such as Fixed Deposits, Recurring Deposits, or simply park their money in a Savings Account. Amount invested is safe, liquid and offer returns in range of 3-7%*

Government Small Savings Schemes

Various government schemes such as Public Provident Fund, Sukanya Samriddhi Yojana offer guaranteed returns which are usually higher than what banks or post office offers. However, government schemes usually are not liquid. The returns are in range of 7-8%*

In mutual funds, various investors pool in money in a fund which is managed by a fund manager who invests the money in securities such as stocks, bonds, etc. The combined holdings of the mutual fund is known as Portfolio. There are various types of mutual funds depending on the needs of the investor. One may invest in mutual funds via “Systematic Investment Plan” commonly known as “SIP” which works on the concept of averaging. It allows investors to to invest a fixed amount at fixed intervals as per their liking. Mutual funds are liquid but don’t offer guarantee of principal amount nor returns but have a potential to generate double digit returns in the long term.

Stock also known as direct equity is ownership in a company. The difference between direct equity and mutual funds is in the selection process, decision making and Risk-Reward. In a mutual fund, a fund manager takes the decision and in direct equity, the investor selects the stock. The risk-reward is usually higher in stocks compared to mutual funds but mutual funds are considered safer for those investors who don’t understand the stock market. Money invested in stocks is not guaranteed, somewhat liquid but has the potential to generate higher returns compared to any other product.

Other investments such as property, gold, currency and other experimental investments offer different unique benefits and are suitable for specific needs of an investor.

Real Estate

Gold

Currency

Crypto Currency