Our approach to wealth management is to uphold our philosophy in each facet of our relationship with our clients. We develop a comprehensive understanding of where you and your family stand financially today, and the direction you’re heading. We take pride in our tradition of unparalleled customer service and our dedication to exhaustive plan implementation. We also schedule regular check-ins to evaluate the progress of your portfolio.

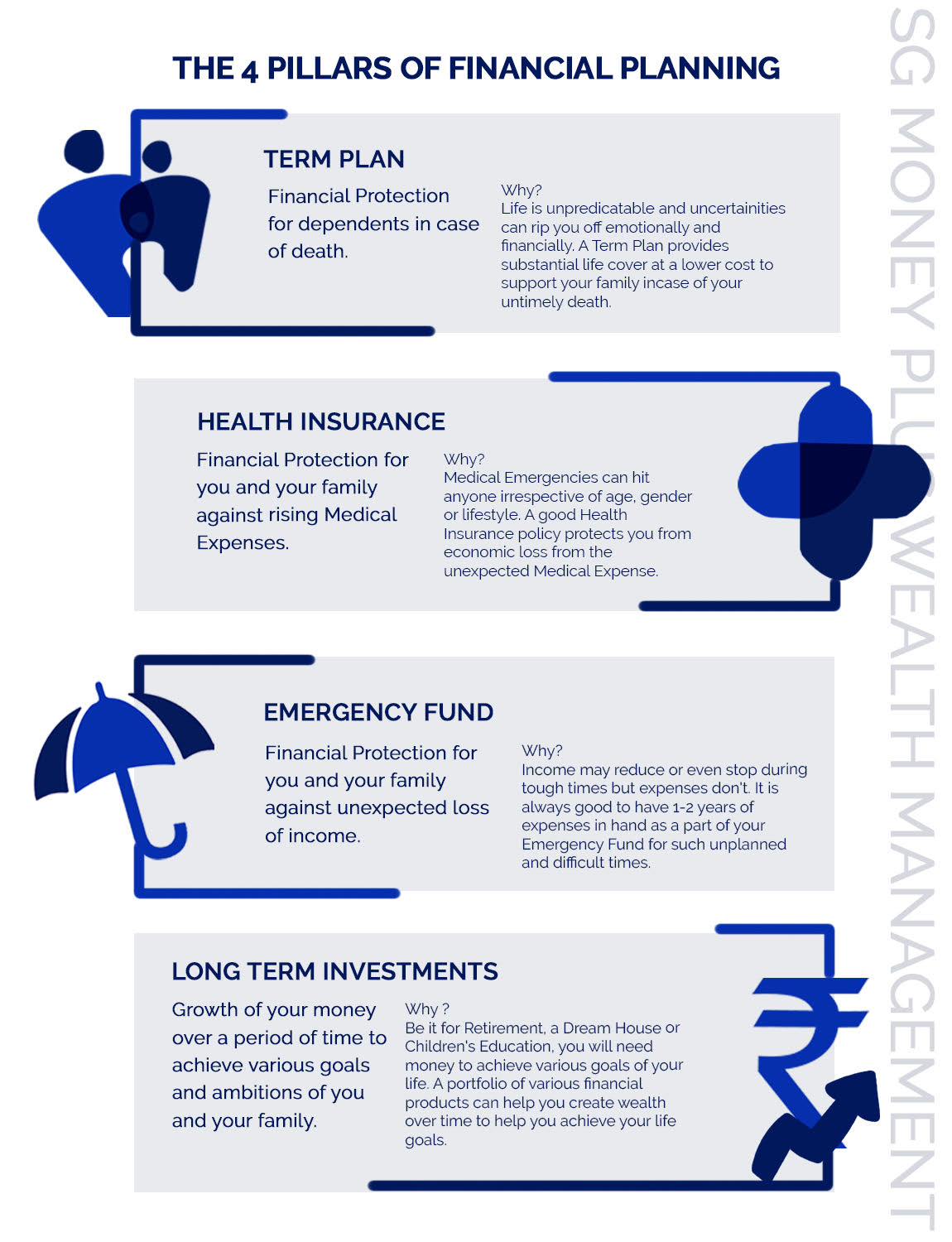

Our personal wealth management approach consists of 4 planning categories. We call them our “planning pillars,” and we draw on each of these areas of expertise to accomplish your goals.

A term insurance is a good, affordable way to create financial security for your dependents in case of an unfortunate event. Whether you are single, newly married, a young parent, or have retired parents, we help you in becoming financially prepared to help your loved ones lead a secured future.

The second leg of the plan would be health insurance. Someone rightly said, “Health is Wealth”. If one is healthy, wealth can be created, if one is not a picture of good health, wealth can be destroyed. With the constant increasing prices of healthcare in our country, and with the ever-rising instances of diseases, a good medical insurance policy has become a necessity.

A lot of people often ignore the importance of liquidity. Loss of income, slowdown, unemployment are events which can happen without notice and hence once should have an emergency fund which is purely liquid to cover 1-2 years of expenses. Remember, there might be a situation where income reduces but expenses keep running, as evident by the global milieu. Thus, this helps you during those tough times.

Once our focus areas have covered the protection needed – the next leg focuses on growth via Investments. We follow the 3D approach of diversification, discipline and data driver in our Investments. We combine various products of debt and equity depending on pre-defined goals and help you in building a strong portfolio to ensure that all your short term and long term goals are achieved. We use products like mutual funds, direct equity, international equity, IPOs, NCDs, bonds, gold, private equity, structured products, AIFs etc. to build a strong diversified portfolio across various asset classes.

Disclaimer:

This website may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this message, please delete it immediately and notify the sender. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs. SG Money Plus Private Limited Financial Services or its proprietor (with ARN code 123867) makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however, caused, in connection with the use of, or on the reliance of its product or related services. Planning pillars is a general concept and may not be relevant to all individuals. Investment options is for reference purpose only and does not include many more aspects or options available to invest. AUM comprises all types of assets not limited to mutual funds or equity and changes time to time. Financial calculators are for reference purposes only and do not assure any returns. Terms and conditions of the website are applicable.